Zoning issues and gentrification have much to answer for

Australian media has long been focussing its commentary on the property market. In fact, most of the time, when our major metropolitan dailies aren’t serving up clickbait on their online mastheads, they’re writing about the real estate market in our major cities that usually consists of a mix of generally favourable pieces (“clearance rates hit record highs!”) and doom and gloom prophecies (“Aussie property bubble about to burst!”). This is even more so now with all the election-based talk about negative gearing.

But for all the talk, the way the media covers Australia’s rising housing prices is most typically only ever a thinly veiled attempt to either balance out the more favourable stories or lend weight to the doom and gloom ones, like the 60 Minutes segment that alleged the Australian housing bubble was going to burst like it did in the US in 2007 and throw Australia into a recession.

Why the property market crash just isn’t likely happen

However, let’s be straight — the Australian property market is nothing like America’s. We don’t have subprime mortgages, we don’t have an oversupply of housing (indeed quite to the contrary, as you will soon see), and there are fairly tough restrictions around the kind of predatory lending that goes on in America, which occurred thanks to two successive decades of extreme banking deregulation. (Not that Australia’s banking industry hasn’t been substantially deregulated in recent years, but at nowhere near the rate that it has been in the US.)

In fact, if you’re interested, there’s a fine analysis of the Australian property market, and what makes a market crash exceedingly unlikely over at Selling Your Property. That’s not to say Australia’s property prices haven’t raged out of control for a number of years, most especially in the last decade-to-fifteen years after the Howard Government introduced the CGT-discount for in 1999 that made loss-making investment properties particularly lucrative to a lot of people.

But it isn’t negative gearing alone that’s caused Australia’s property prices to reach the levels they have, especially in areas of Sydney, like the Northern Beaches, where the median house price is now $1.29 million, a figure well above the city average of a little under a million. No, the greatest contributing factor in Sydney’s rising house prices, especially on the northern beaches, is a combination of gentrification, population growth and government levies and taxes.

The factors affecting housing affordability are not unique to the northern beaches — they either have occurred or are currently occurring in other parts of Sydney too, namely the inner city, inner west and north west — but the northern beaches is representative of an overall gentrification of Sydney suburbs that’s putting pressure on housing affordability. And for the sake of this blog post, we decided to highlight this region of Sydney that’s gone from insular peninsular to millionaire’s row in less than a decade.

From insular peninsular to millionaire’s row

Take Balgowlah, for example. It used to be a sleeper suburb located within the Manly LGA. Between 2006 and 2011, house prices grew a modest 6.6 percent, which is impressive considering that period also coincided with the GFC that saw prices in other regions either decline or remain the same. Then, in the five years that followed 2011, house prices in Balgowlah grew a whopping 49 percent — seven times the rate of the previous five years.

By April 2016, the median house price had reached $1.89 million, an increase of 19 percent in just twelve months. Local real estate agents were keen to chalk this up to renewed confidence in the northern beaches property market, following 12 months of fairly unimpressive growth between 2011 and 2012, but that isn’t the real cause of the northern beaches’ escalating house prices.

A major driving force behind house prices on the northern beaches is population growth. Between 2006 and 2011 (the period covered by the most recent census), the Manly LGA population grew 14 percent, yet the total number of dwellings in the Manly LGA remain unchanged since 1991.

The houses are bigger, but that’s not necessarily better

In theory, then, walking the streets of Balgowlah in 2016 shouldn’t look any different to what it did in 1991. Only, that’s not the case. Building approvals in the Manly LGA have seen fairly steady growth since 2001. And aside from a spike in low density building approvals in 2007, which coincided with the area’s largest development of apartments in nearly two decades (the redevelopment of the Totem Shopping Centre by Stockland and the construction of a few hundred apartments above it) the majority of building work that has been carried out was to existing dwellings.

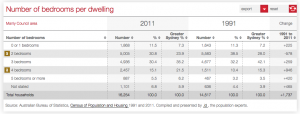

In the decade to 2011, as the number of two bedroom dwellings in the Manly LGA declined by 10 percent, the number of four bedroom dwellings increased by 38.5 percent, while the number of dwellings with five or more bedrooms nearly doubled. In Balgowlah, especially, there are fewer ‘average sized’ two-and-three bedroom houses, and far more four and five bedroom ones. This data confirms what’s been known anecdotally for a while: Balgowlah and the northern beaches has undergone the same gentrification that’s been seen in the inner city, inner west, and elsewhere in Sydney over the last two decades.

The Northern Beaches attracts cashed-up North Shore buyers

This brings us back to that ‘sleeper suburb’ reference we made earlier in this blog post. For years, residents of the Northern Beaches were always considered down at heel. It was where people lived when they couldn’t afford to live on Sydney’s more affluent North Shore. The Manly LGA region, in particular, was characterised by a lot of older-style two-and-three bedroom homes, built during the interwar years and not dissimilar to the homes you still find in San Francisco and parts of Southern California.

But all that started to change about a decade ago. Priced out of the Mosman property market, and in search of a better lifestyle, Balgowlah and the immediate localities of Seaforth and Clontarf – the ‘gateways to the north shore’, as they were, tongue-planted-firmly-in-cheek, sometimes referred – started to look mighty attractive.

In 2006, the median house price in Mosman was $2.23 million; in Balgowlah, it was $1.19 million. A Mosman homeowner could trade in their average Mosman home and pick up a decent one in Balgowlah, with money still left over for a substantial renovation. And that’s exactly what they did. During the last decade, the two most common LGAs from which people migrated to the Manly LGA were Mosman and Ku-ring-gai – Sydney’s lower and upper north shore.

And as property prices continued to soar, the prohibitive cost of stamp duty has made it more appealing for homeowners to renovate an existing two or three bedroom home, rather than to trade up. In doing so, the variety of housing types have declined significantly. Your choice, if you can’t afford a $1.89 million house in Balgowlah, is to live in an apartment, of which the median price is now $942,000.

Councils need to look at rezoning, rather than new building

These trends have also been observed in other parts of Sydney that, due to their close proximity to the CBD, have become highly sought after. The concern, of course, is that as these areas become more and more gentrified, it will force other, lower-income households further afield, or possibly out of Sydney altogether. If that occurs, it poses a serious question as to the future survival of key services in these areas, especially in the retail, hospitality and healthcare industries, which are vital to the community.

Sydney is one the most sparsely developed cities in the world, due to its preoccupation with the Great Australian Dream. It’s an unfortunate reality, but Sydney is never going to become the next New York, where families raise children in gardenless apartments, and travel most places on foot, rather than by car. That much is clear when you look at ABS data of the number of dwellings approved in New South Wales, which shows construction of freestanding houses consistently outpaces the construction of any other dwelling type ever since 1985 (when data was first collected).

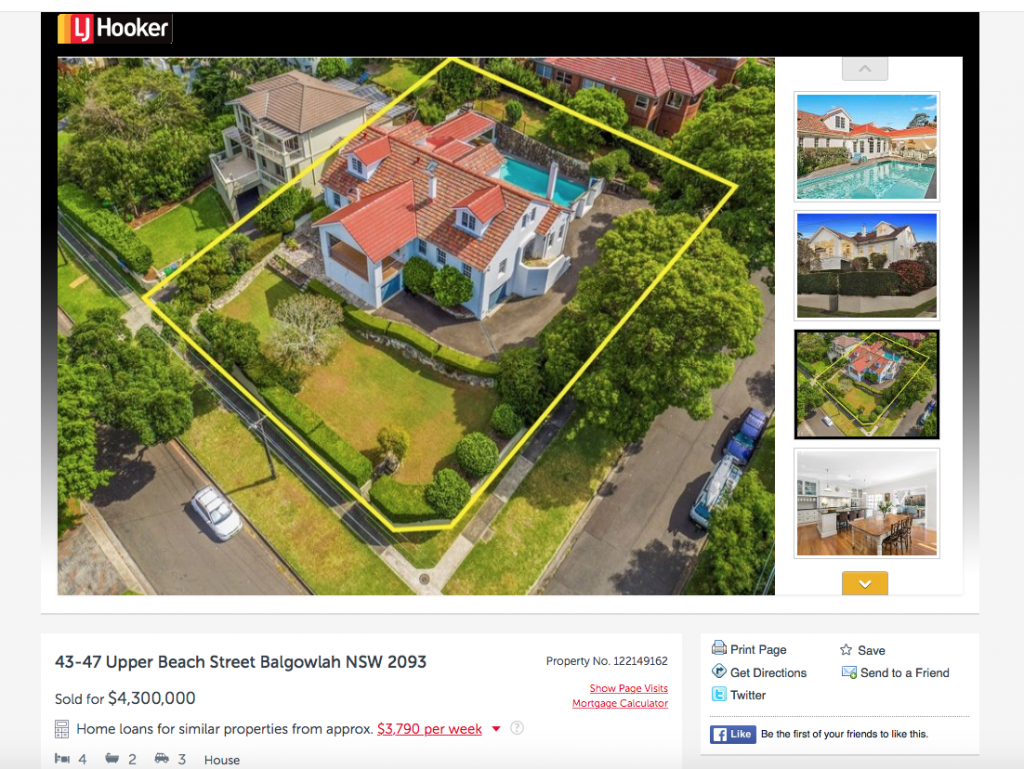

But a lot of this is to do with council zoning. Most suburbs around Sydney are zoned for low-density housing. That’s your freestanding house on your quarter acre block of land, just like the below house in Balgowlah, which recently sold for $4.3 million, and occupies almost 1,400sqm of land — nearly three times the land size of most new-home development packages (it’s even numbered 43-47). Homes like these are common. But if even just a small proportion of them had been rezoned for medium density housing in suburbs all over Sydney, it could have gone a long way to ease housing stress and, importantly, make housing more affordable.

At the moment, as Australia’s population grows — which really just means our two largest capital cities, Sydney and Melbourne, are growing, since that’s where the jobs and major services are — property prices will continue to rise unabated until, unable to spend money on much else besides their mortgage repayments, people will stop spending on other areas of the economy. But that won’t occur until long after Australia’s middle class disappears — unless state, local and federal governments do a lot more to address our housing problems. A good place to start is with medium density housing.

Virion specialises in producing well-researched, informative articles that cover every aspect of the real estate industry — from in-depth market analysis, the latest property news, tips, insights, and educational how-tos — as part of our content marketing services. We tailor our content specifically to our agents to establish them as an online authority in their area. Contact our team to find out how we can create content to establish your brand online.